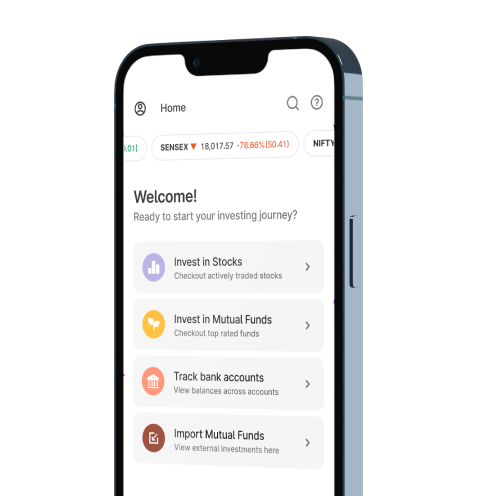

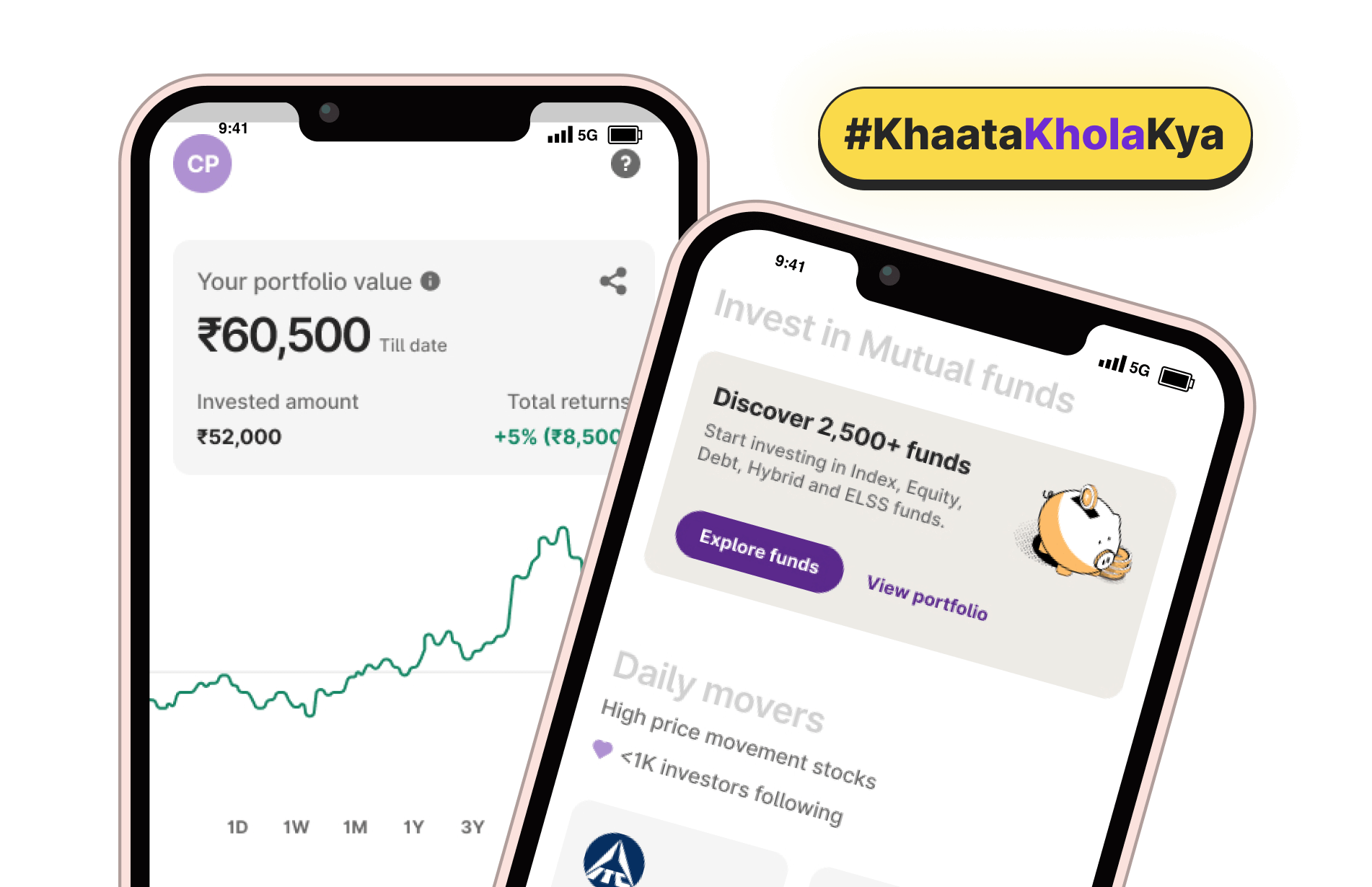

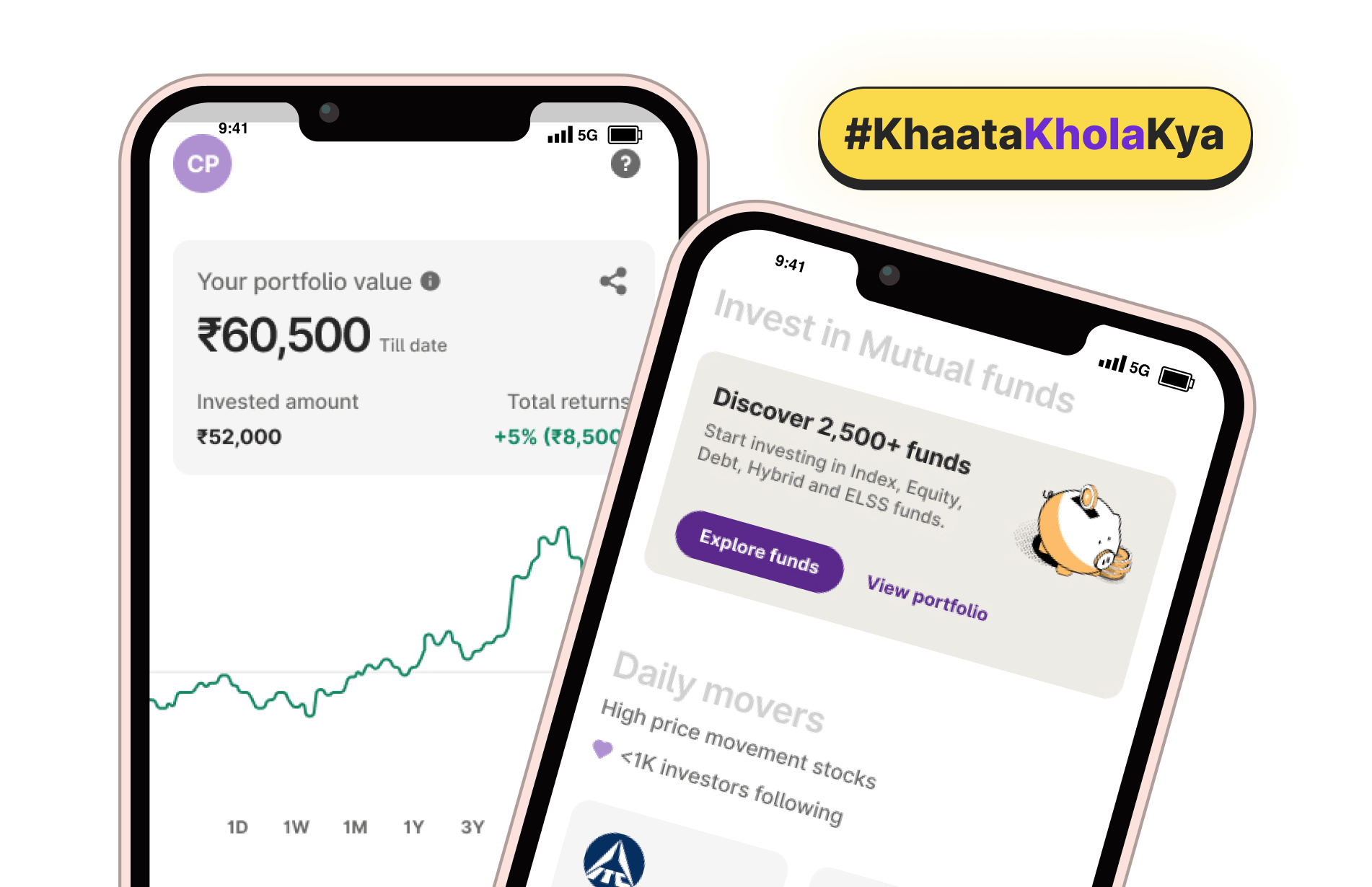

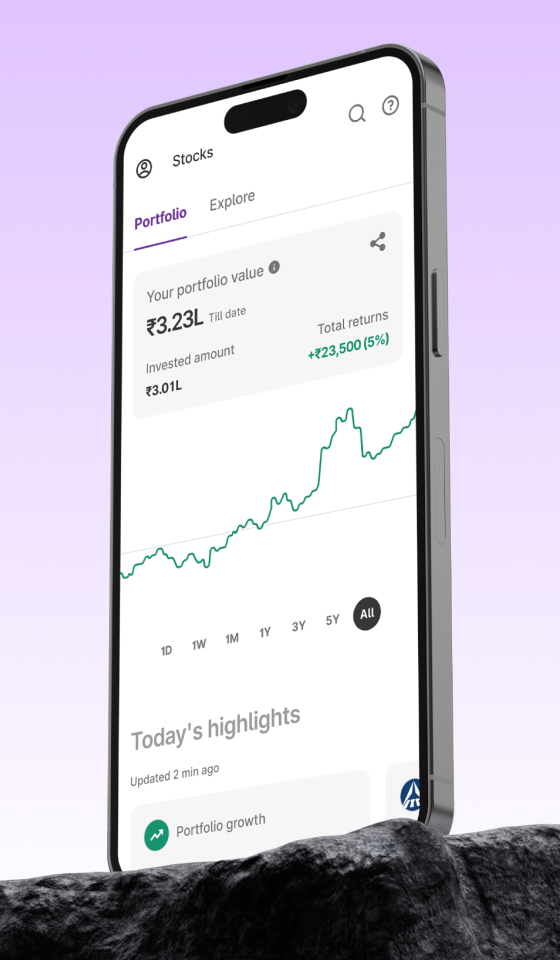

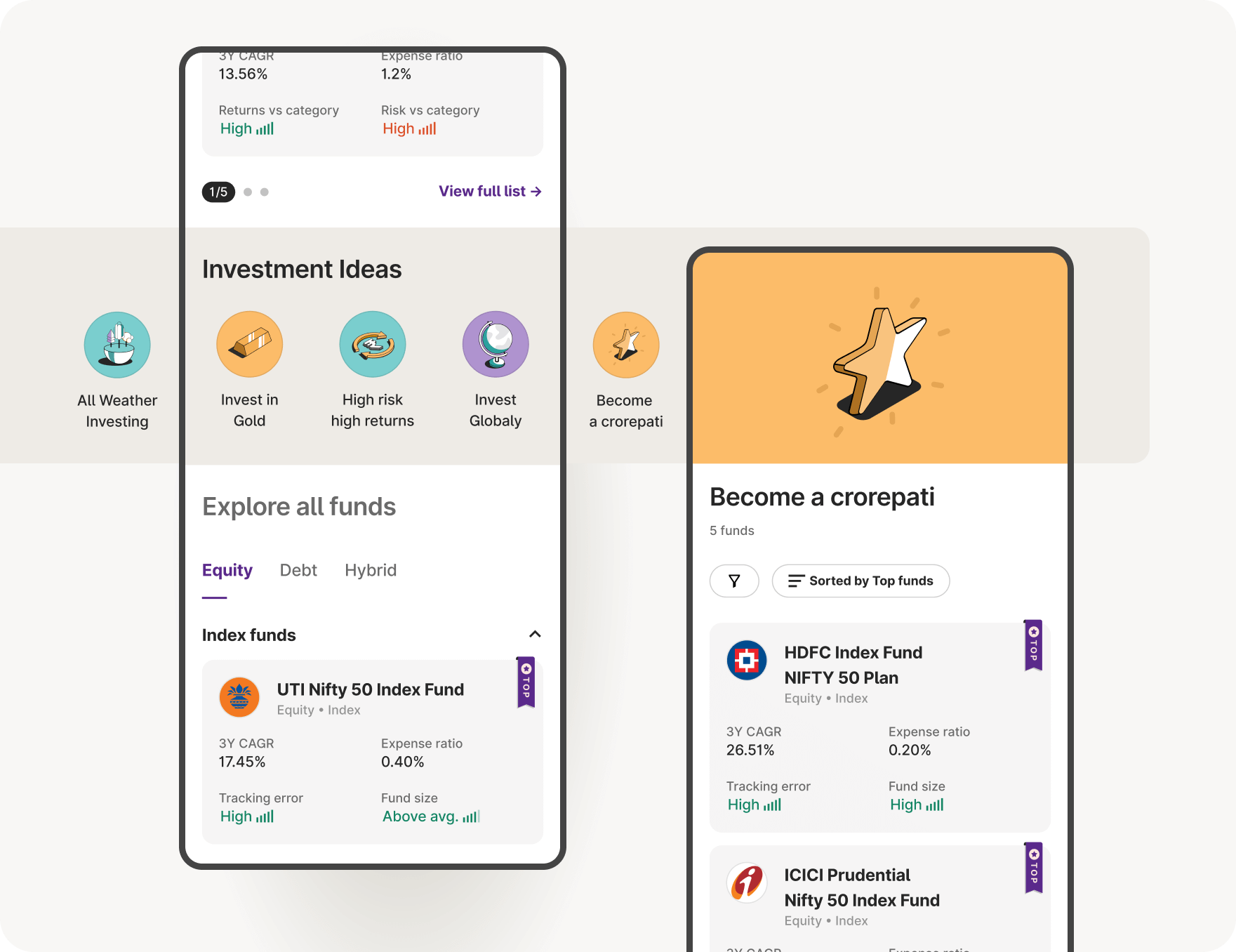

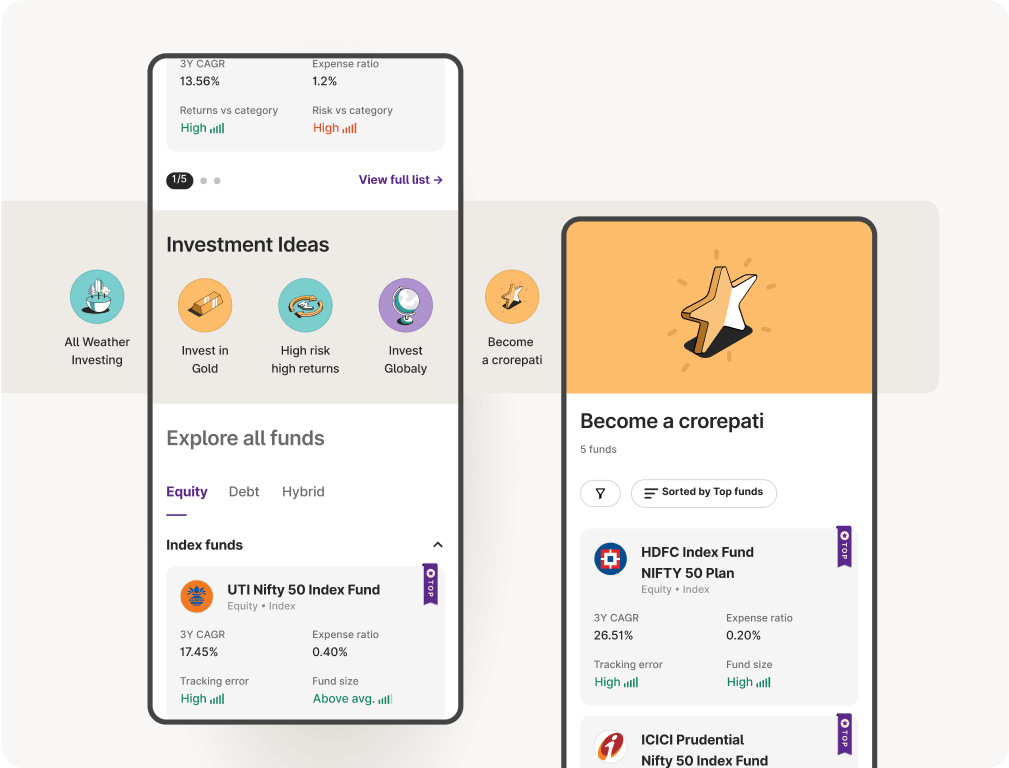

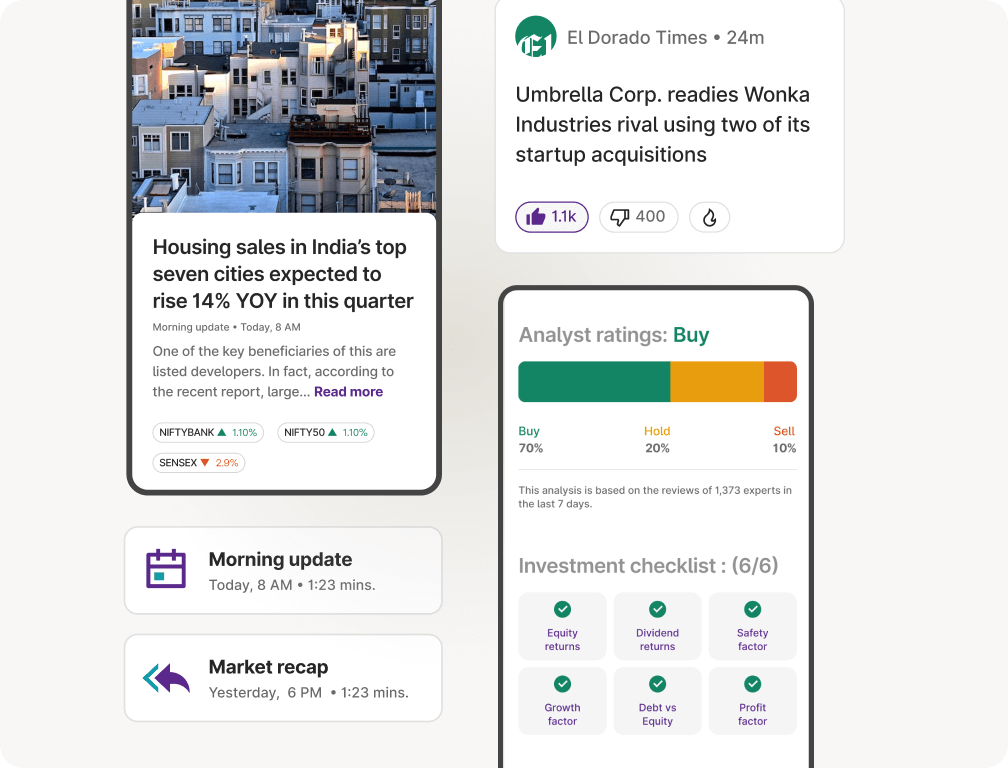

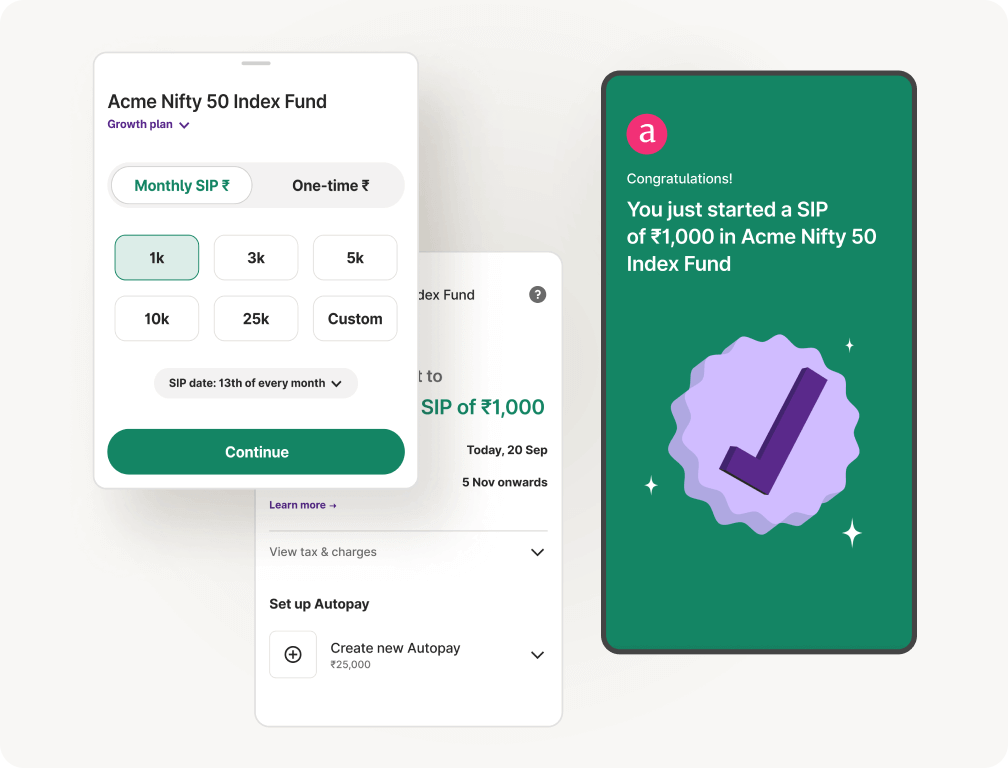

Upstox for Investors

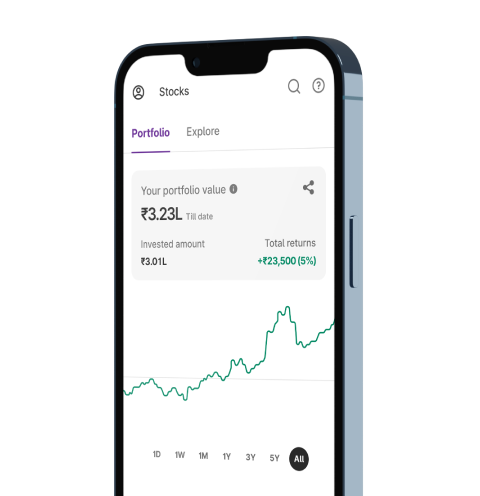

Invest Right, Invest Now in Stocks, Mutual Funds, and IPOs

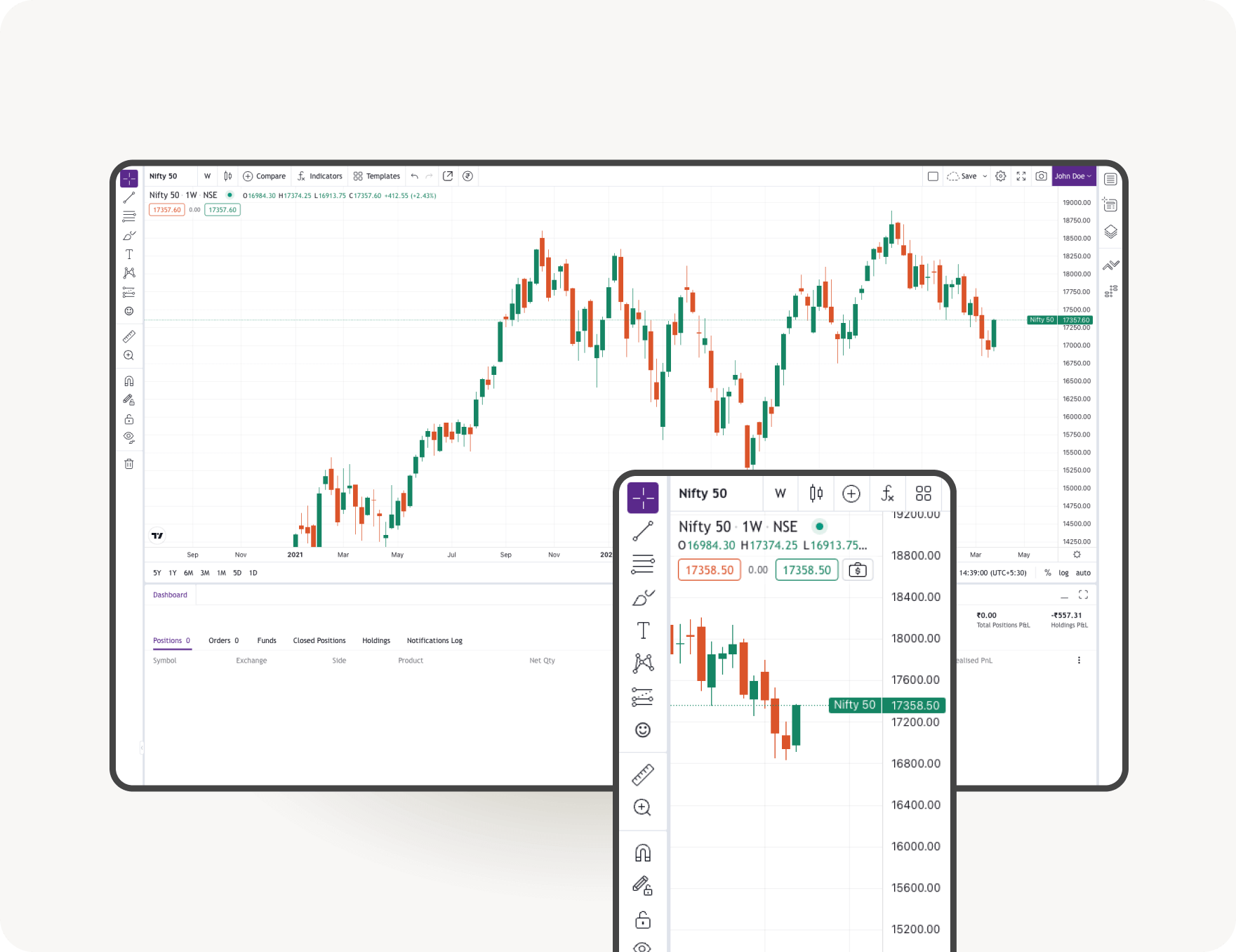

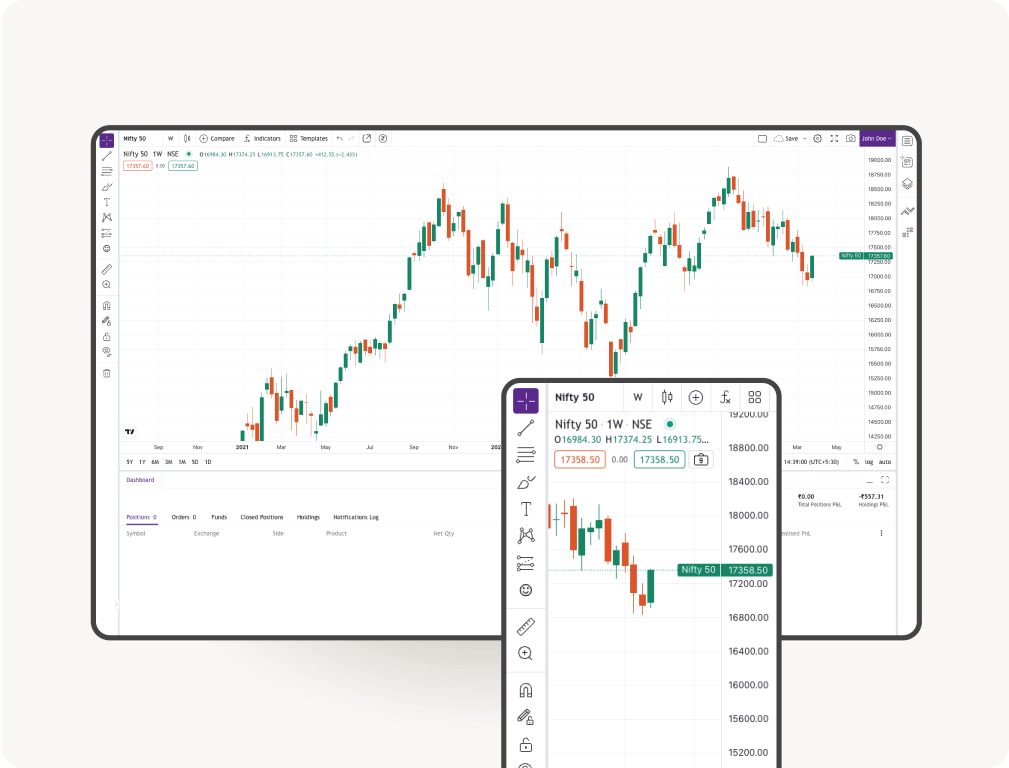

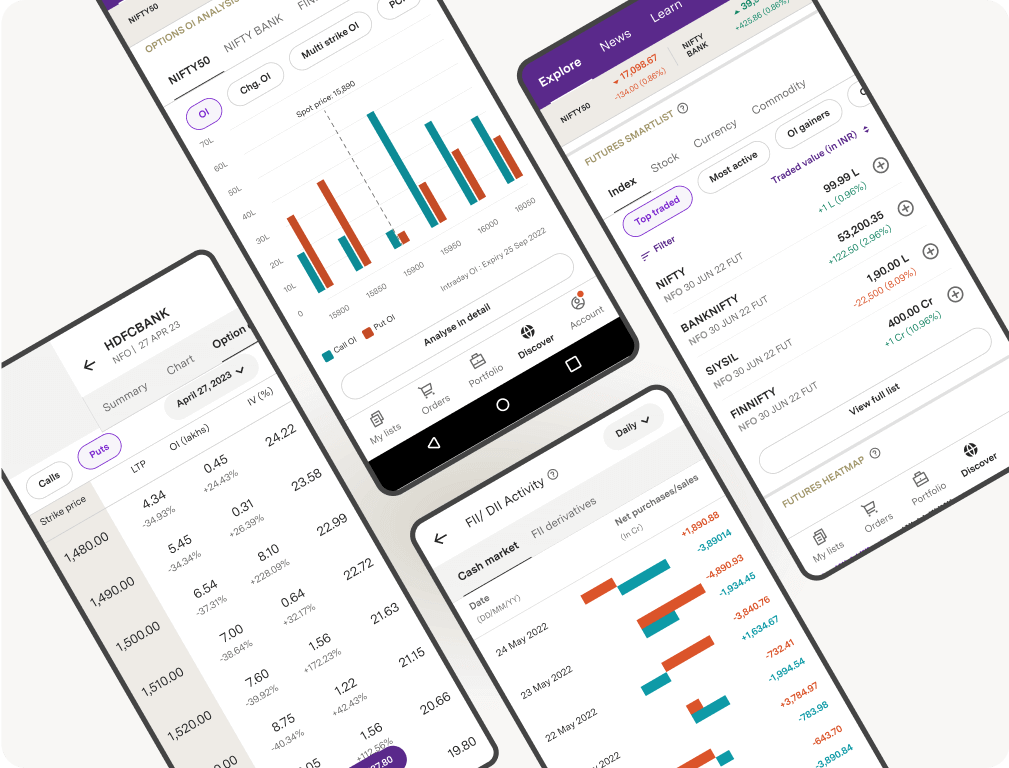

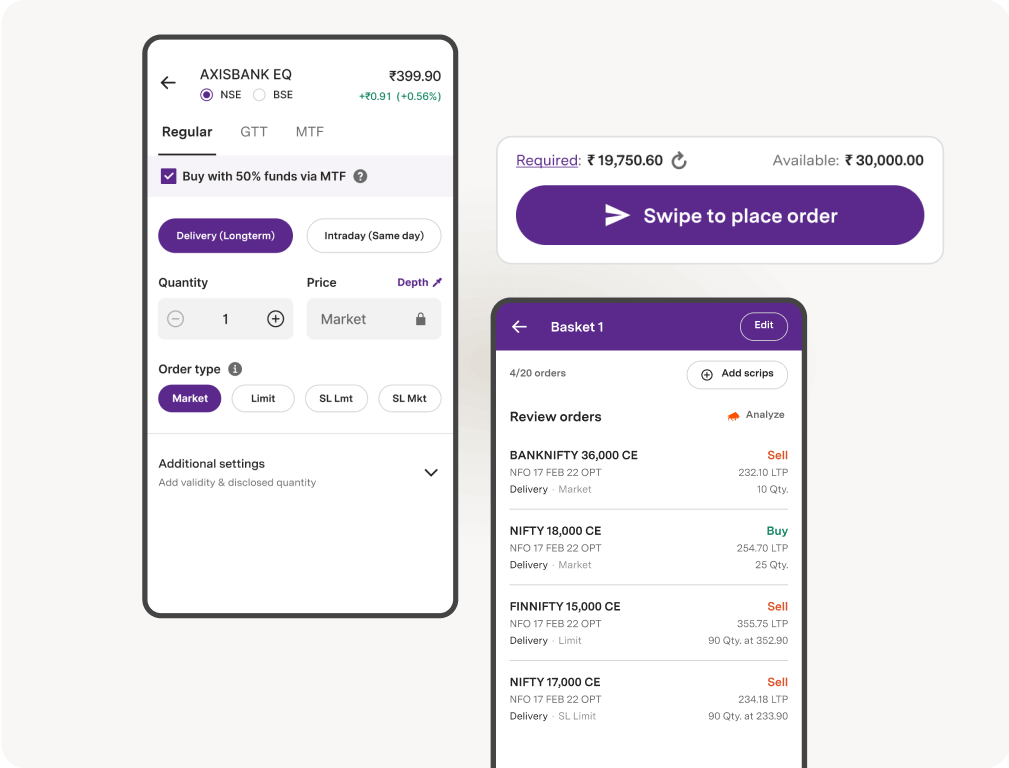

Upstox Pro for Traders

Powerful trading in Equities, Futures, Options, Commodities and Currencies made simple

Learn all about the Stock Market

With our jargon-free and expert-led Courses, Webinars, Events and self-help Videos

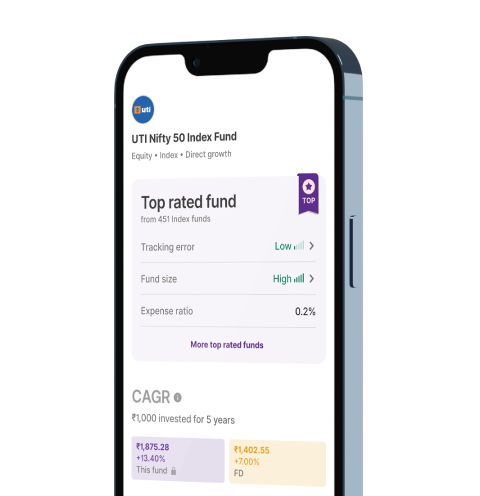

- Top rated funds

- Best for Beginners

- Top 30 actively traded Stocks

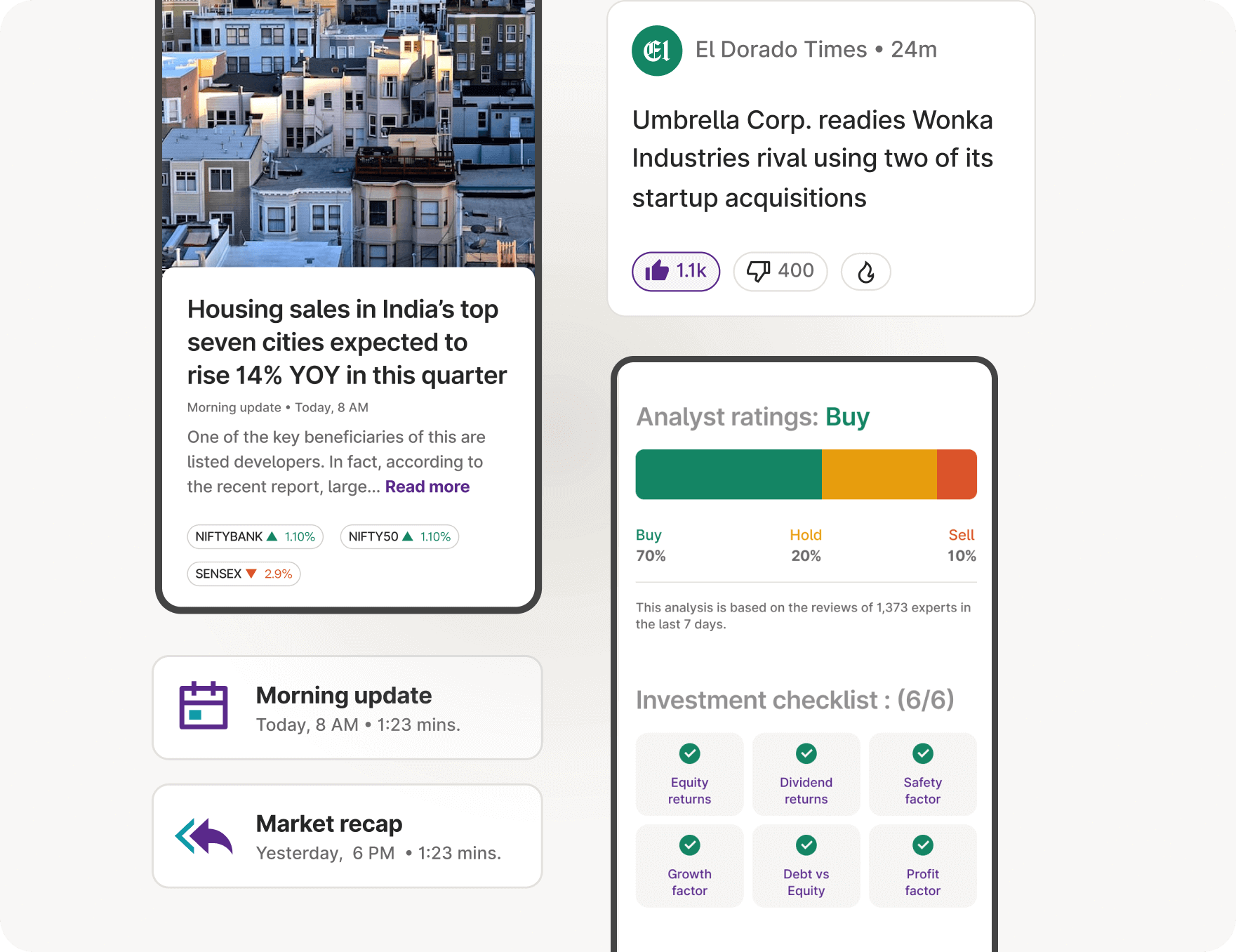

- Analyst ratings

- Investment checklist

- Risk & return related info

- Open 24/7

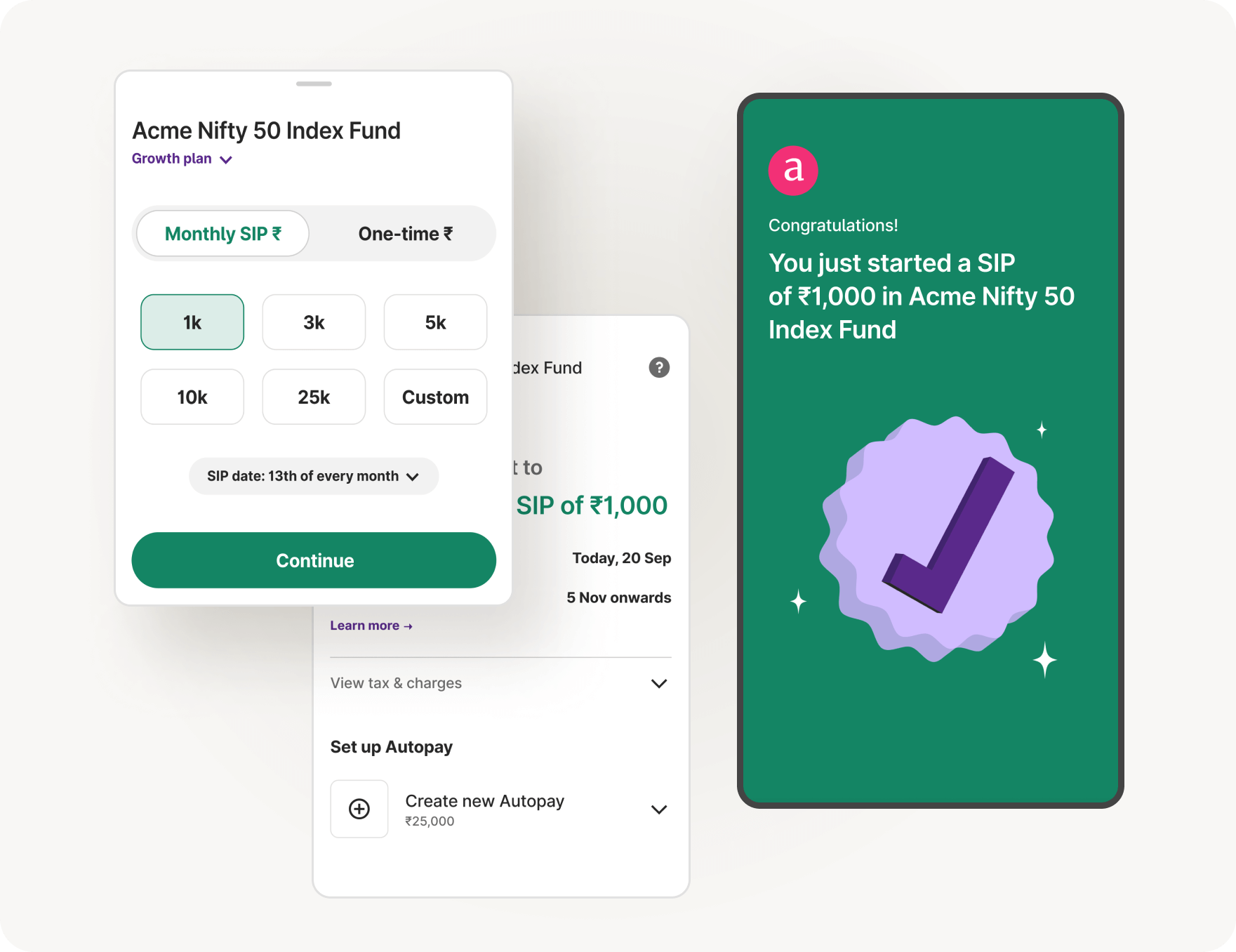

- Pay via UPI

- SIP mode for Stocks & Mutual Funds

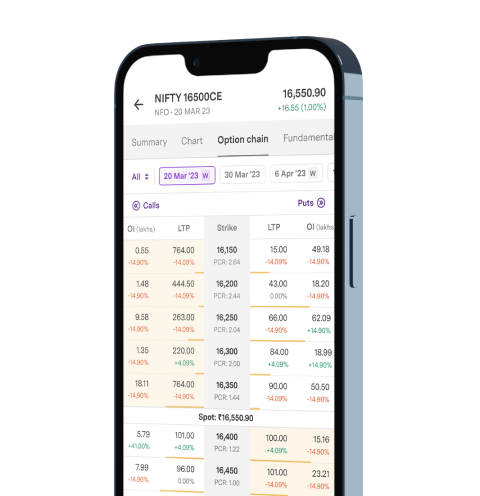

Upstox Pro for Traders

Powerful trading in Equities, Futures, Options, Commodities and Currencies made simple

Learn more- TradingView

- 8 Charts at once

- 100+ Indicators

- 80+ Drawing tools

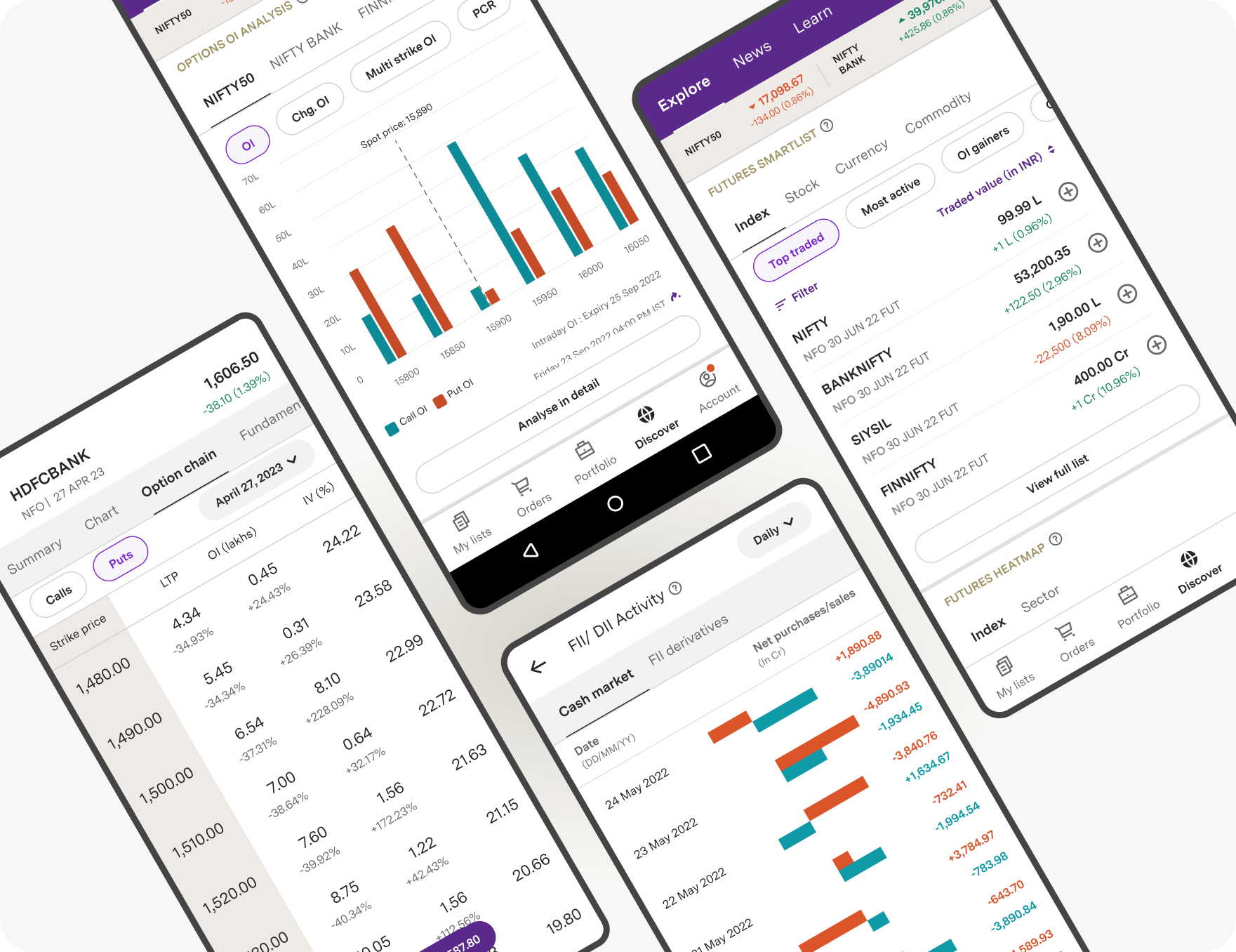

- OI Analysis

- Option Chain with Greeks

- FII & DII Data

- F&O Smartlists

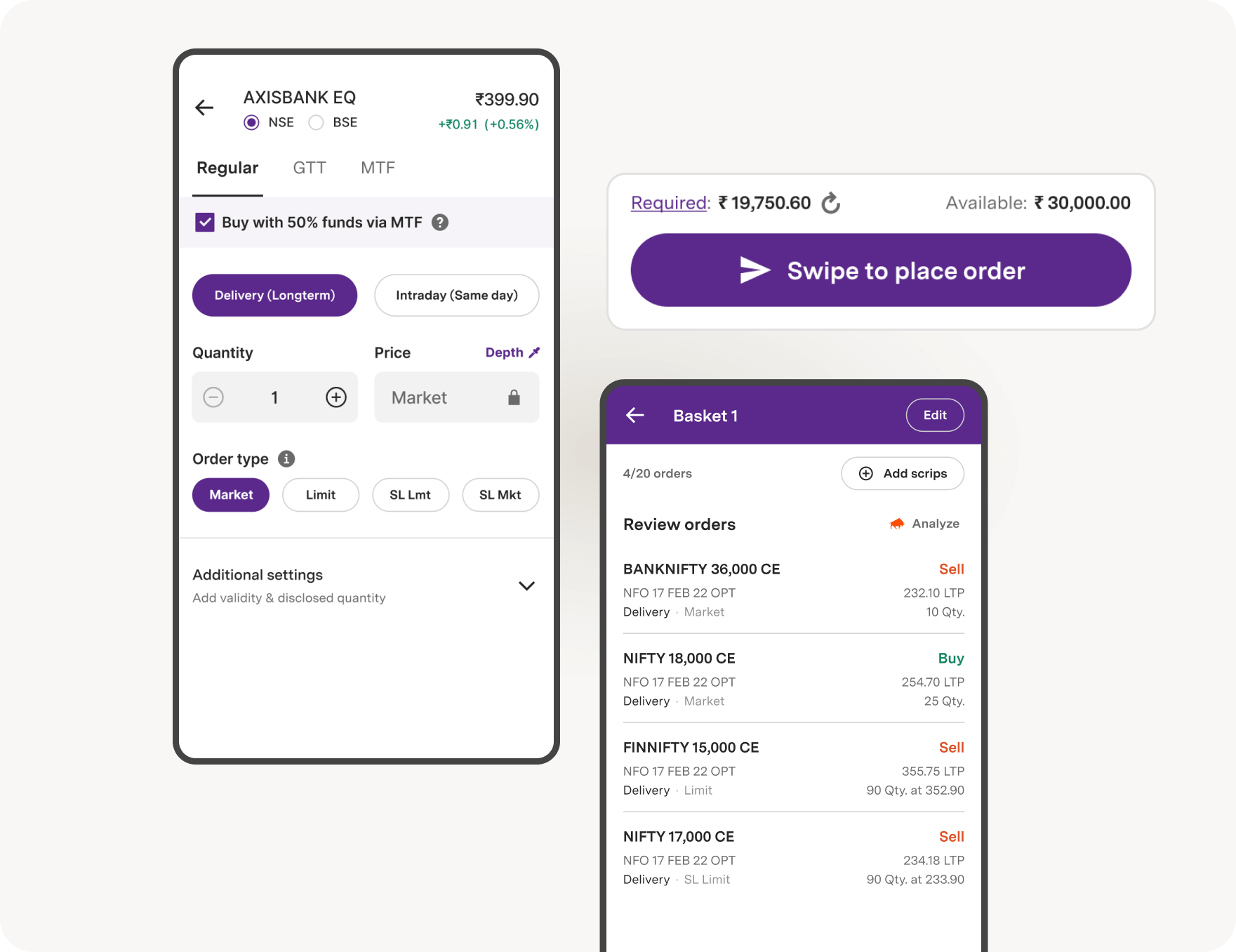

- GTT

- Basket orders, with up to 10 orders

- 2X Margin via Margin Pledge on 450+ Stocks

Learn all about the Stock Market

With our jargon-free and expert-led Courses, Webinars, Events and self-help Videos

#InvestRightInvestNow

Know our storyTransparent pricing. No hidden charges.

View pricing*Zero AMC is applicable for customers onboarded after August 2021

0

Demat + Trading Account Charges

0

Account Maintenance Charges

0

For Mutual Funds and IPOs

20

For Equity, F&O, Commodity and Currency Trades

Calculate Brokerage & Margin easily

- Brokerage Calculator

- Margin Calculator

- Option Strategy Builder

- SIP Calculator

- Mutual Fund Returns Calculator

- SWP Calculator

HDFC Bank gets RBI nod to buy stake in IndusInd Bank and Yes Bank, Zydus Life hits 52-week high & more